Current Account

It takes courage to start a new business.

It takes energy, knowledge and the right tools, like the current account from Garanti BBVA.

While the company will be busy to grow, the Garanti BBVA current account will work on making all the daily activities easier — payments, deposits and cash withdrawals, foreign exchange, promissory notes, cheques etc.

- Plus, for everything to be the way it needs to be, the current account can be opened in Lei, and in foreign currencies as well - EUR, USD, GBP, CHF, HUF, JPY, CAD, TRY, NOK, SEK, PLN.

Garanti BBVA Current Account offers a lot of benefits

- Various types of transactions, like payments to suppliers, utilities, state budget debts and taxes, through payment orders or debit instruments

- The possibility to deposit cash easily at Garanti BBVA agencies or Garanti BBVA ATMs, or through debit instruments and by payment orders

- Foreign exchange transactions between a Lei current account and a foreign currency current account

- Cash withdrawals and deposits in Lei at any Garanti BBVA ATM

No need to worry about the costs

- Find out more about costs according to Standard tariffs and commissions for SME customers.

How to apply

Online

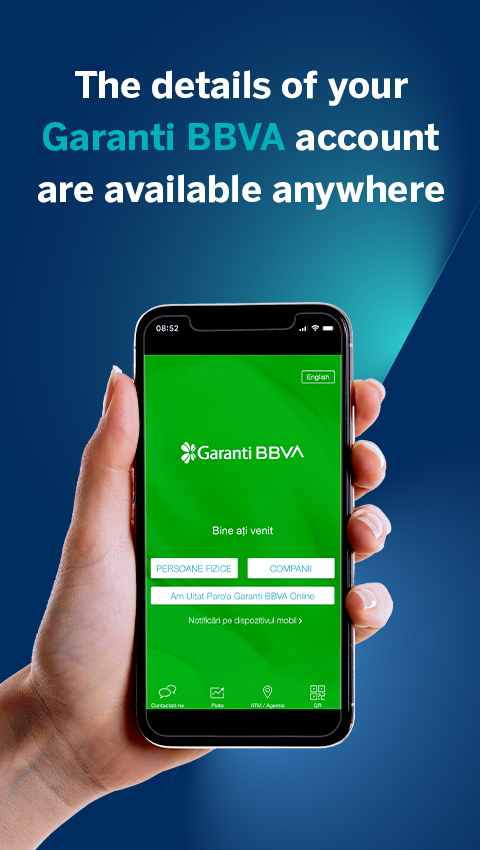

You can open an online account yourself in Garanti BBVA Online

In agencies

You can come to any of the Garanti BBVA agencies

The funds deposited in current accounts, savings accounts or time deposits opened by customers with Garanti BBVA are protected through the guarantee scheme administered by the Bank Deposit Guarantee Fund, up to 100,000 EUR, Ron equivalent, as specified in the conditions from Information Form for Depositors and in the List of Deposits Exempted from Compensation, which you can read here.

Garanti BBVA services and products

Account Management Services

Garanti BBVA Online helps you to keep track of all transactions and to archive them in a more convenient way.

Salary Convention

A trustworthy bank and the help it provides are essential to keep a balance between the employees’ happiness and the firm’s profit growth.