Short and Medium Term Loans

It happens. Sometimes companies are in need. But when this happens, Garanti BBVA is there to help.

- Flexible collaterals: assignment of receivables, cash collateral, pledges, mortgages or movable collaterals may be combined

- Simplified documentation and quick decision making

Credit line for current activity related payments

It is designed to finance the company’s current activity, with a structure adapted to the Borrower’s business specifics.

Product characteristics:

- Loan Type: revolving credit line;

- Facility purpose: financing the Borrower’s current activity (settlement of the existing obligations towards suppliers, State Budget, salaries, other current expenses etc.);

- Availability Period: 12 months after approval date;

- Maturity: correlated with the specifics of the company activity;

- Utilization: anytime during the use of the facility;

- Repayment: anytime during the life of the facility, but no later than the maturity date.

- Flexible structure: the utilization of the approved limit can be done anytime during the lifetime of the facility based on justifying documents. The maturity of each drawdown is correlated with the cyclical activity of the Borrower. Reimbursements will be made according to the agreed schedule or any time within the final maturity, at the Borrower’s request.

- Revolving character: amounts repaid can be reutilized over the entire availability period of the facility.

- Multiple options: multi-currency/ multi-borrower.

Overdraft

It is a type of loan through which the Bank puts at the Borrower’s disposal a working capital limit, dimensioned based on the financing gaps in the operational activity of the company.

Product characteristics:

- Type of Loan: credit limit attached to the current account of the company;

- Facility Purpose: financing the Borrower’s current activity;

- Availability Period: 12 months after approval date;

- Maturity: 12 months after approval date;

- Utilizations: anytime during the availability period of the facility to pay the available limit current account attached;

- Repayment: anytime during the life time of the facility, but no later than the maturity date; any inflow to the current account with overdraft limit automatically reduces the loan outstanding and increases correspondingly the available limit of the overdraft.

- Flexible structure: utilizations of the approved limit can be done anytime during the lifetime of the facility without presenting to the bank justifying documents. Repayment is done automatically by the amounts collected in the current account of the company.

- Revolving character: repaid amounts can be reutilized over the entire availability period of the facility.

- Multiple options: multi-currency / multi-borrower, the company can choose the most suitable option for its current activity financing.

Credit line based on performed receivables

Everything comes with the positive and negative traits, even for companies. Get the support that you need for your business directly from Garanti BBVA. With the Credit line based on performed receivables, invoices for suppliers, utilities and current state debts can be paid. The maturity of the credit line is up to 9 months maximum drawing period, depending on the type of debit instrument discounted. Also, the loan value is calculated according to the value of the instruments belonging to your company, correlated with the company’s yearly turnover as of the latest registered balance sheet.

The Credit line from Garanti BBVA offers a lot of benefits

- Instant access to use the money for the company, from the instruments to be cashed

- Simplified documentation and fast decision

- The cashing period for accepted instruments can be up to 90 days for Promissory Notes and up to 120 days for invoices

- Attractive interest rates and commissions

It’s super easy to get it

You can visit one of the Garanti BBVA agencies or contact us via e-mail at contact@garantibbva.ro

Spot loan

The small investments are very important when growing a company. And if something useful is needed for the company, the spot loan from Garanti BBVA is just perfect. Why? Because it is a loan for urgent payments and small scale investments. The maturity of the loan is up to 6 months and its value is correlated with company’s financials and ongoing projects.

The Spot loan from Garanti BBVA offers a lot of benefits

- Flexible collaterals: assignment of receivables, cash collateral, pledges, mortgages or movable collaterals

- Simplified loan documentation, financial analysis and loan utilization

- Attractive interest rates and commissions

It’s super easy to get it

You can visit one of the Garanti BBVA agencies or contact us via e-mail at contact@garantibbva.ro

Installment loan for current activity

It is designed to finance the company’s current activity and it is granted with the aim to optimize its operational flow of the company and has predefined destination (payments towards suppliers, salaries, State Budget taxes etc.).

Product characteristics:

- Description: short term loan in Lei /Euro/USD;

- Purpose: financing the company’s current activity, with predefined destination (settlement of current obligations towards suppliers, State Budgets, salaries, other current expenses etc);

- Maturity: max. 12 months from the date of each utilization;

- Utilization: based on justifying documents, in accordance with the purpose of financing. The facility unfolds via a separate account from the current account;

- Reimbursement: each drawdown will be reimbursed in a predetermined number of days, according to the operational cycle of the Borrower;

- Personalized structure: the utilization of the approved limit can be done anytime during the lifetime of the facility, within the maximum loan limit approved. The contractual maturity of each loan utilization can be set at 1, 3 or 6 months interim tenor, according to a repayment plan set based on the company’s cash flow.

- Multiple options: the company can chose the structure that best fits is current activity from the following options: multi-currency, multi-products and / or multi-borrower credit facilities.

Installment loan for un-nominated needs

Sometimes, businesses have unpredictable needs. With the Installment loan for un-nominated needs from Garanti BBVA, you can ask for up to 100,000 EUR (in Lei equivalent) to help your business. The maturity of the loan is maximum 66 months, correlated with the financing needs of the company, and there’s a grace period up to 6 months if you need one. The loan dimensioning comes according to the company’s financial situation.

The Installment loan for un-nominated needs from Garanti BBVA offers a lot of benefits

- Required collaterals: mortgages on immovable, residential properties

- Simplified documentation and fast decision

- Attractive interest rates and commissions

It’s super easy to get it

You can visit one of the Garanti BBVA agencies or contact us via e-mail at contact@garantibbva.ro

Bancassurance

In order to keep everything in control when it comes to a company, focusing on things that have to be done is mandatory. But in some situations a company can face problems that are uncontrollable. Don’t worry. Fortunately Garanti BBVA offers a set of insurances for commercial buildings, equipments, machinery, fleets, stocks and any other goods. Moreover, our team can assist you and your company with the wide range of insurance products for the loans contracted from Garanti BBVA.

It’s super easy to get it

You can visit one of the Garanti BBVA agencies or contact us via e-mail at contact@garantibbva.ro

Information regarding insurance policies:

How to apply

Contact us

By email: contact@garantibbva.ro to get details on the product

In agencies

You can come to any of the Garanti BBVA agencies

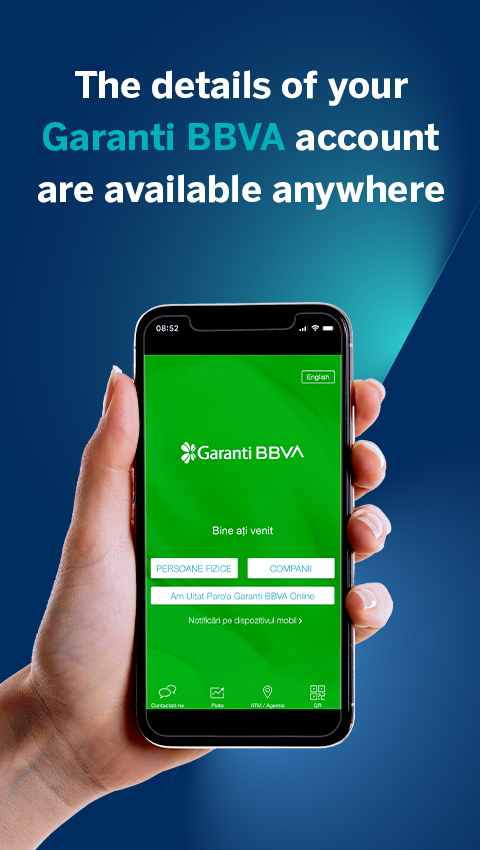

You might also be interested in

Account Management Services

Garanti BBVA Online helps you to keep track of all transactions and to archive them in a more convenient way.

Salary Convention

A trustworthy bank and the help it provides are essential to keep a balance between the employees’ happiness and the firm’s profit growth.